Bills and money can be stressful. Add a pandemic to the mix and the topics can become even more nerve-wracking. On the flip side, personal finances can sometimes surprise us in pleasant ways. As I mentioned in the “How She Does It with Marva Smith” interview, one of the highlights of 2020 was that my family became 100% debt-free. (Yay!) Some people have asked “how” we did that so I want to share the five personal budgeting tips that helped.

Since I come from a finance background, I handle creating my family’s household budget. I create it with my husband Reggie’s input and then Reggie makes sure that we actually stick to it. (Left unchecked, I could totally ruin our finances with eating out and buying gifts!) That’s why we make a great team.

I have been using the method that I’m going to share with you for as long as I can remember…since pre-marriage and kids days. I have actually taught these tips to various women whom I have mentored over the years also. They work!

Personal Budgeting Tips

1. Write down all of your debt.

Write everything that you owe anyone financially on an Excel or Google sheet. When I say everything, I mean everything. If you owe family members or friends anything, write it down. If you have an old magazine subscription that you haven’t paid, write it down.

Doing so helps you to have a sober estimate of where you stand financially. I’m not going to lie, people have burst out in tears after doing this first step but it has helped them to manage their finances better.

2. Decide how you are going to “tackle” your debt.

There are a couple of main options that are normally suggested. You could pay the smallest debts first so that you can have some “quick wins”. Another option is to pay the highest interest debt first.

Personally, I suggest paying off any “past due” bills first – that includes any money that you said that you would pay family and friends back but haven’t. For me, it’s about personal integrity and not taking advantage of those who love you the most. Then, I like the quick wins/snowball method.

This debt-repayment method (which excludes your mortgage) focuses on paying off your smallest debt balances first while making minimum payments on all other debts.

Once a balance is paid off, you take the funds you had previously allocated to your smallest debt and put them toward the next-smallest balance, essentially building, or “snowballing,” your repayment toward the next balance. This cycle repeats until all of your debt is repaid.

CREDIT KARMA

3. Create a basic budget…and stick to it.

There are two basic elements to a budget – income (money that you bring in) and expenses (money that you pay others). Ultimately, your goal is for your income to exceed your expenses.

I use three columns in my household budget for expenses.

| Expenses | Predicted | Actual |

Under each column, you would include a row for each expense. For instance, my rows include Tithes & offering; Reggie’s personal spending; My personal spending; Boys’ Expenses; Work-related spending; Parents; Groceries; Rent; Cell Phones; Cable; ConEd; National Grid, Insurance 1, Insurance 2, Insurance 3, Laundry & Household; Gas & Transportation; Kids 529 plans; Credit cards; Streaming Services (Netflix, etc.); Savings; Investments; Entertainment and Miscellaneous (gifts and non-recurring expenses).

Your expenses will be different based on your lifestyle. If you aren’t clear on what your line items should be, write down everything that you spend for a month, then lump the expenses together to make your categories. Just realize that your expenses will change over time. (For instance, our food bill increased so much this past year but our transportation bills went way down.)

I do the same thing for income.

| Income | Predicted | Actual |

The rows are basically Reggie’s income and my income. Reggie’s income is stable but my income fluctuates. As such, I budget my income based on what I already earned the previous month.

Budgets don’t have to be super restrictive. Within these personal budgeting tips, there’s a lot of room for choice. You’ll just want to move towards your income being greater than your expenses. In reality, there are only two ways to do that – decrease your expenses or increase your income. (I prefer the latter option but that’s not always possible in every situation. Next week, I’ll briefly write about multiple streams of income.)

4. Get clear on your financial goal(s).

There are many different things that we can focus on when it comes to personal finances. Making sure that our income exceeds our expenses, paying off debt, increasing our savings, buying homes, paying for our kids’ college and investing are just some of the areas that we can be concerned about.

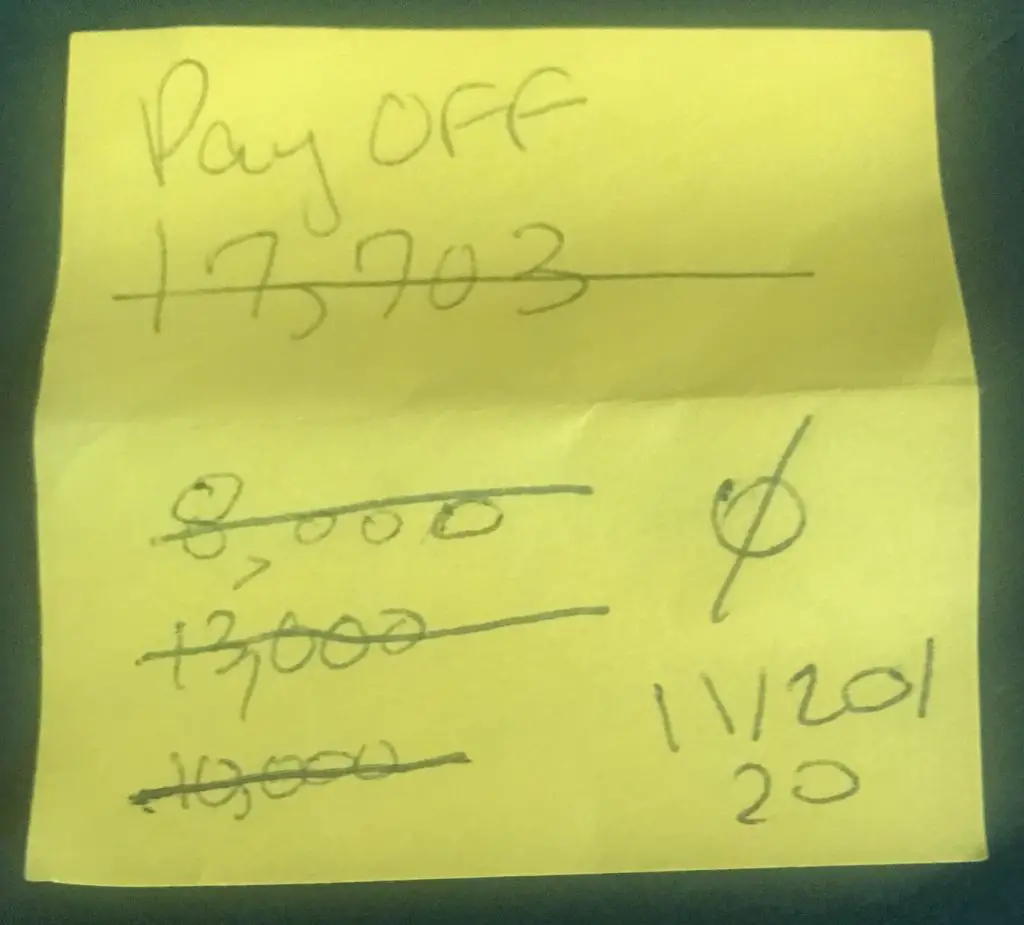

It can be overwhelming so I try to focus on one main thing at a time – while not neglecting the other areas that are important to my family. For instance, being completely debt-free was my focus and in my special “Post-It prayer” box for a while. Initially, we were $17,703 dollars in debt. Then, it was $8,000. Then, we were down $13,000 (braces!) and $10,000 before we hit the $0/debt-free mark on 11/20/20. (It would have been great if I had put the dates associated with the numbers along the way but I didn’t think about it.)

Now that the debt is paid off, we are focusing on saving and investing more this year. Next year, we will probably focus on college payments. Those 529s aren’t going to cover everything so my hope and plan is that the residual income from one of my businesses will pay for our sons’ schooling. They are three years apart so that helps spread out payments. (I just don’t want our kids to graduate saddled with a bunch of debt!)

Those are my family’s short-term goals. What are yours?

5. Decide how long you are willing to take to meet your goals.

When budgeting, think about how long (best-case scenario) you want to take to meet your financial goal(s). Budget accordingly. As long as you are paying your bills on time if you can, I think the timing is a personal decision.

For instance, I was totally fine with maintaining debt in the form of a student loan for a long time. I just paid my scheduled monthly student loan bill when the interest was tax-deductible. When I suspected that the interest policy would change (it did), I went ahead and paid off my balance.

You will hit your financial goals faster if you are stricter with your budget. I remember a budgeting class that was held at my church back when I was a college student. The presenter shared three different budget options. The only one that I remember was the “draconian” one because it didn’t leave room for any fun splurges. “No, thank you” then. “No, thank you” now.

As a mom, I have heard some financial experts talk about the extremes that they have gone to in order to quickly get out of debt. I remember one person saying that she decided to cancel Christmas for her entire family. I’m impressed that she did that. It worked for her family. “No thank you, ma’am” regarding me doing that for my family though. (I have no problem canceling Christmas for my husband and myself but I’m not canceling Christmas or birthdays for my kids unless I’m super broke!)

That’s the beauty of choice. I have a “but I won’t do that” list in my mind regarding moving towards financial goals. I won’t stop:

- tithing

- celebrating the special days of my closest loved ones (husband, kids, parents + a few additional people whose “love language” is gifts)

Think about what you’re willing to do and what you’re not willing to do in order to meet your financial goals. Plan accordingly. You will have to sacrifice something in order to meet your financial goals but you still have some choice in the matter.

I hope that these personal budgeting tips help you in the management of your (and your family’s) personal finances. Keep moving forward and you will get to your goals!

If you enjoyed this post, please share it. In addition, consider signing up for my weekly email newsletter so that you don’t miss future updates. Thanks!